Introduction

Managing money is one of the most important life skills, yet many people never learn it properly. When you start earning, it often feels like money disappears too quickly. Bills, food, transport, and small daily expenses slowly add up. Without a plan, saving becomes difficult and stress becomes common. This is where budgeting plays a key role.Budgeting is not about being strict or stopping yourself from enjoying life. Instead, it is about giving your money direction. When you know where your money is going, you feel more confident and relaxed. Beginners often think budgeting is complicated, but in reality, it is very simple when done the right way.

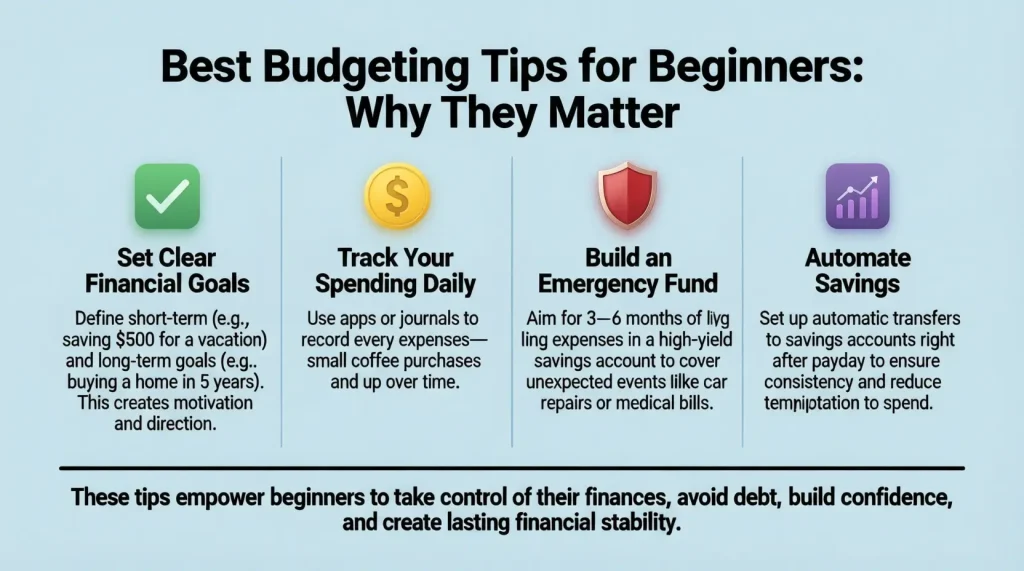

The best budgeting tips for beginners focus on clarity, control, and consistency. You do not need expensive tools or advanced knowledge. You only need basic awareness and a willingness to improve step by step. Even small changes can lead to big results over time.

What is Best Budgeting Tips for Beginners?

Budgeting means planning how you will use your money before you spend it. It helps you divide your income into different categories such as expenses, savings, and personal needs. For beginners, budgeting should be simple, flexible, and realistic.

The best budgeting tips for beginners are easy methods that help you manage money without pressure. These tips guide you to understand your income, track spending, and make smarter choices. Budgeting is not about perfection. It is about progress.

A beginner-friendly budget focuses on awareness. When you know how much you earn and how much you spend, you can control your finances better. Over time, budgeting becomes a habit, not a task. It supports your lifestyle instead of restricting it.

Why is Best Budgeting Tips for Beginners Important?

Budgeting is important because it gives you control over your financial life. Without a budget, money often goes to unnecessary things. This leads to stress, missed savings, and debt problems.

Here are some key reasons why budgeting matters:

- It helps you avoid overspending

- It encourages saving regularly

- It reduces money-related stress

- It prepares you for emergencies

- It helps achieve long-term goals

The best budgeting tips for beginners help build strong money habits early. These habits protect you from financial mistakes and give you confidence. When you manage your money well, you can plan your future with clarity and peace of mind.

Detailed Step-by-Step Guide

Step 1: Know Your Monthly Income

Start by calculating your total monthly income. Include your salary, freelance work, side income, or any other regular earnings. Always use the amount you actually receive after deductions.

If your income changes monthly, calculate an average based on recent months. This gives you a stable number to plan with.

Step 2: Track All Your Expenses

Write down everything you spend money on for at least one month. This includes small purchases like tea, snacks, or transport.

Divide expenses into two categories:

- Fixed expenses such as rent, bills, and internet

- Variable expenses such as food, shopping, and entertainment

Tracking expenses helps you understand your spending habits clearly.

Step 3: Set Clear Financial Goals

Goals give your budget purpose. Decide what you want to achieve with your money.

Examples include:

- Saving for emergencies

- Paying off loans

- Buying a phone or laptop

Set realistic goals so you stay motivated.

Step 4: Create a Simple Budget Plan

Now divide your income into categories. Keep it simple.

A common structure:

- Essentials: 50 percent

- Savings: 20 percent

- Personal spending: 30 percent

Adjust these percentages based on your needs.

Step 5: Start an Emergency Fund

An emergency fund protects you during unexpected situations. Start small if needed. Even a small amount saved regularly matters.

Aim to save at least one month of expenses first. Increase it gradually over time.

Step 6: Cut Unnecessary Expenses

Look at your expense list and identify items that are not essential. Reduce spending on things that do not add value.

Cooking at home, limiting online shopping, and avoiding impulse buying can save a lot of money.

Step 7: Review and Improve Monthly

Budgeting is an ongoing process. Review your budget every month. Adjust it if your income or expenses change.

Mistakes are normal. Learn from them and keep moving forward.

Benefits of Best Budgeting Tips for Beginners

- Better control over money

- Improved saving habits

- Less financial stress

- Clear understanding of expenses

- Strong long-term financial discipline

- Reduced risk of debt

- Improved confidence in financial decisions

Disadvantages / Risks

- Requires consistency and effort

- May feel restrictive in the beginning

- Needs regular monitoring

- Can be frustrating if goals are unrealistic

- Takes time to become a habit

Common Mistakes to Avoid

Many beginners fail at budgeting because of small mistakes. One common mistake is ignoring small daily expenses. These small costs add up quickly.

Another mistake is setting unrealistic savings goals. This leads to disappointment and quitting. Some people also forget to update their budget when income changes.

Stopping budgeting after one bad month is another common issue. Budgeting is about learning, not being perfect. Avoid comparing your budget with others. Everyone’s financial situation is different.

FAQs

What is the best budgeting method for beginners?

A simple percentage-based budget is best for beginners. It is easy to understand and flexible enough to adjust.

How much should beginners save monthly?

Beginners should aim to save at least 10 to 20 percent of their income. Starting small is completely fine.

Is budgeting possible with low income?

Yes, budgeting is even more important with low income. It helps you prioritize needs and avoid unnecessary expenses.

Do I need apps for budgeting?

No, apps are optional. You can budget using a notebook or spreadsheet. The method matters more than the tool.

How long does budgeting take to work?

You may see improvements within the first month. Long-term results usually appear after a few months of consistency.

Can budgeting help avoid debt?

Yes, budgeting helps control spending and plan repayments. It reduces the chances of taking unnecessary loans.

Expert Tips & Bonus Points

Always be honest with yourself about spending habits. Track expenses daily for better control. Review your budget weekly if possible.

Use cash for categories where you overspend. Reward yourself for small achievements. Keep learning about personal finance to improve results.

Most importantly, be patient. Budgeting is a skill that improves with time and practice.

Conclusion

Learning how to manage money early can change your financial future. The best budgeting tips for beginners are not complicated rules. They are simple habits that help you stay in control of your income and expenses.

Budgeting helps you understand where your money goes and how to use it wisely. It allows you to save, plan, and enjoy life without constant stress. You do not need to be perfect to succeed at budgeting. You only need consistency and honesty.

As your income grows, your budget will evolve with you. Keep reviewing, adjusting, and improving your plan. Over time, budgeting becomes a natural part of your life.

By following these beginner-friendly budgeting tips, you build a strong financial foundation. This foundation supports your goals, protects you from emergencies, and gives you confidence. Start today, stay consistent, and let your money work for you.