Introduction

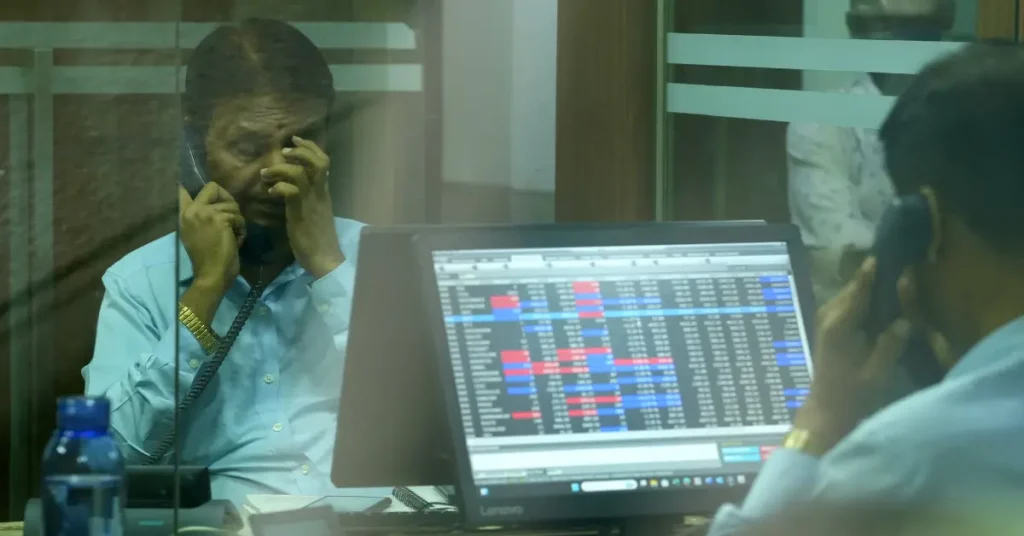

India’s stock benchmarks set for worst day in over four months on renewed tariff worries has become a major talking point among investors and market watchers. The sudden rise in tariff-related concerns has shaken confidence and triggered heavy selling across key indices. For beginners and intermediate investors, such sharp market moves can feel confusing and stressful. However, understanding the reasons behind this decline is essential for making calm and informed decisions.

When tariff worries resurface, they often signal potential pressure on trade, corporate earnings, and overall economic growth. As a result, investors turn cautious and reduce exposure to riskier assets like equities. India’s stock benchmarks set for worst day in over four months on renewed tariff worries reflects not just local concerns, but also global uncertainty and changing trade dynamics.

What is India’s Stock Benchmarks Set for Worst Day in Over Four Months on Renewed Tariff Worries?

India’s stock benchmarks set for worst day in over four months on renewed tariff worries refers to a sharp single-day decline in major indices like the Sensex and Nifty due to fears of new or higher trade tariffs. Tariffs are taxes imposed on imported goods, and they directly affect trade costs and company profits.

When investors hear about possible tariff increases, they worry that exports may slow and input costs may rise. This can reduce earnings for companies, especially those linked to global trade. As a result, selling pressure increases across sectors.

In this situation, markets react quickly because future growth becomes uncertain. India’s stock benchmarks set for worst day in over four months on renewed tariff worries highlights how policy concerns can override short-term positive data and create widespread nervousness.

Why is India’s Stock Benchmarks Set for Worst Day in Over Four Months on Renewed Tariff Worries Important?

This market movement is important because it affects investor wealth, confidence, and planning. A sharp fall reminds investors that external factors like trade policies can impact markets suddenly.

It also shows how global events influence Indian markets. Even if domestic fundamentals are strong, international tariff disputes can cause volatility. For new investors, this event is a learning moment about risk and uncertainty.

India’s stock benchmarks set for worst day in over four months on renewed tariff worries also impacts retirement portfolios, mutual funds, and short-term traders. Understanding its importance helps investors prepare better for similar situations in the future.

Detailed Step-by-Step Guide

Step 1: Understand What Triggered the Tariff Worries

Markets reacted to news suggesting renewed tariff tensions between major economies. Investors feared a slowdown in global trade.

Step 2: Observe Market Reaction Carefully

Indices fell sharply, and sectors linked to exports, metals, and IT faced higher selling pressure.

Step 3: Analyze Sector-Wise Impact

Some sectors fall more than others. Export-driven companies usually react first to tariff fears.

Step 4: Check Global Market Signals

Global markets often guide domestic sentiment. Weak overseas cues added pressure locally.

Step 5: Review Your Portfolio Exposure

Investors should check how much of their portfolio depends on global trade-sensitive sectors.

Step 6: Avoid Panic Decisions

Sharp falls tempt investors to sell quickly. Staying calm is crucial during such days.

Step 7: Look for Long-Term Signals

Short-term volatility does not always change long-term growth stories.

Benefits of India’s Stock Benchmarks Set for Worst Day in Over Four Months on Renewed Tariff Worries

- Creates buying opportunities for long-term investors

- Highlights importance of diversification

- Encourages better risk assessment

- Improves understanding of global linkages

- Promotes disciplined investing behavior

Disadvantages / Risks

- Sudden losses in portfolio value

- Increased market volatility

- Emotional stress for new investors

- Short-term uncertainty in earnings outlook

- Negative sentiment across sectors

Common Mistakes to Avoid

One common mistake is panic selling during sharp declines. Many investors exit at the worst possible time. Another error is ignoring long-term goals and focusing only on daily market movements. Overreacting to news without understanding its real impact can also harm returns. When India’s stock benchmarks set for worst day in over four months on renewed tariff worries, patience becomes extremely important.

FAQs

What caused India’s stock benchmarks to fall sharply?

Renewed tariff worries increased fears of trade disruptions and lower corporate earnings.

Are tariff worries permanent?

In most cases, tariff concerns are temporary and depend on policy discussions and negotiations.

Should beginners exit the market during such falls?

No. Beginners should focus on long-term goals and avoid emotional decisions.

Which sectors are most affected by tariff fears?

Export-oriented sectors like IT, metals, and manufacturing are usually more affected.

Can markets recover after such a fall?

Yes. Markets often recover once clarity improves and fears reduce.

How can investors protect themselves?

Diversification, long-term planning, and calm decision-making help reduce risk.

Expert Tips & Bonus Points

Experts suggest staying invested and using volatility to review portfolio quality. Focus on companies with strong balance sheets and stable demand. Keep some cash ready for opportunities created by sharp corrections. Regularly updating knowledge helps investors respond wisely to events like India’s stock benchmarks set for worst day in over four months on renewed tariff worries.

Conclusion

India’s stock benchmarks set for worst day in over four months on renewed tariff worries serves as a reminder that markets are sensitive to global and policy-related developments. Even strong domestic indicators cannot fully shield markets from international uncertainty. For investors, this event highlights the importance of understanding risks beyond company fundamentals.

While such days can be unsettling, they are a normal part of investing. Markets move in cycles, and periods of fear often create opportunities for disciplined investors. Instead of reacting emotionally, investors should analyze the reasons behind the fall and assess whether long-term prospects have truly changed.